UNITED STATESSECURITIES AND EXCHANGE COMMISSIONWashington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

(Amendment No.__)

| Filed by the Registrant | ||

| Filed by a | ¨ |

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, | |

| ☑ | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material |

|

| Levi Strauss & Co. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Levi Strauss & Co.

(Name of Registrant as Specified In Its Charter)(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| ☑ | No fee | ||

| Fee paid previously with preliminary materials | |||

| ¨ | Fee computed on table | ||

Notice of Annual Meeting

of Shareholders and Proxy

Statement

April 19, 2023 (Wednesday)

10:30 a.m. (Pacific Time)

WHO WE ARE

|

A company doesn’t last 170 years

| ||

|  | ||

| |||

|

| “We have a lot of excitement in the queue from the celebration of the 150 years of the iconic Levi’s® 501® fit to the expanded strength of the company’s management.” |

Levi Strauss & Co. (“LS&Co.”) delivered another strong year of profitable growth in fiscal 2022 with continued progress across categories, geographies and channels. In addition to surpassing $6 billion in total net revenue for the first time since 1997, we also returned $350 million to our shareholders which is an 84% increase over fiscal 2021.

In June 2022, LS&Co. outlined its long-term goals and strategies to become a $9-$10B company. The strategies are working and proven in the company’s fiscal 2022 results. The strategies center on being:

| ● | Brand-Led |

| ● | Direct-to-Consumer (DTC) first |

| ● | And focused on diversifying the portfolio across geographies, categories, genders and channels |

The company’s full brand portfolio has much to be proud of in 2022, from integrating Beyond Yoga® into the portfolio to expanding Dockers® brick-and-mortar presence across the globe to growing the Levi’s® brand global share faster than any other denim brand. The Levi Strauss & Co. of today has expanded well beyond the denim bottoms business of years past and has transformed into an innovative apparel leader with a portfolio of full head-to-toe lifestyle brands.

With an eye on growth, we understand that feedback and engagement with our shareholders are critical to the company’s continued success. We’ve engaged with a number of shareholders over the past couple of years and look forward to continuing our dialogue with you.

We have a lot of excitement in the queue from the celebration of the 150 years of the iconic Levi’s® 501® fit to the expanded strength of the company’s management. This year, we’re honored to have welcomed Michelle Gass to the team as President of LS&Co. and eventual successor to Chip Bergh. Michelle’s deep retail and omni-channel experience as well as her established track record of building brands and meaningful innovation have already proved impactful as we build for the future. We’re certain we have the right levers in place to accelerate the growth of the business and create significant value for our stakeholders.

We’re eager to continue the momentum into 2023 and deliver another year of strong, profitable growth – of course with you all by our side.

ROBERT A. ECKERT

Board Chair

We intend to mail the Proxy Availability Notice on or about March 7, 2023, to all shareholders of record entitled to vote at the annual meeting. We expect that this proxy statement and the other proxy materials will be available to shareholders on or about March 7, 2023.

| 2023 PROXY STATEMENT | 1 |

PERFORMANCE HIGHLIGHTS

| $6.2 billion FY22 net revenue | FY22 Net Revenue Share

* Growth figures reflect the increase in net revenues in fiscal year 2022 compared to fiscal year 2021 calculated on a constant-currency basis. We encourage you to review our Annual Report on Form 10-K for the year ended November 27, 2022. Constant currency metrics are not determined in accordance with accounting principles generally accepted in the United States (GAAP) and should not be viewed as a substitute for the most directly comparable GAAP measures. Additional information regarding our use of constant-currency measures can be found beginning on page 62 of our Annual Report. |

| ~$350 million FY22 capital return to shareholders in dividends and share buybacks | |

| Leading with our Brands* +11% growth in the Levi’s® brand | |

| Prioritizing our Direct toConsumer Business* +18% growth in company total global DTC business | |

| Diversifying Across Geographies, Categories, Genders & Channels* +13% growth in total company women’s business, achieving over $2 billion |

NOTICE OF 2021 ANNUAL MEETING OF SHAREHOLDERSOUR SUSTAINABILITY GOALS FOR 2025

AND BEYOND AND CURRENT PROGRESS

In 2022, we released our 2021 sustainability report, which included an updated slate of 16 goals. We refreshed our holistic sustainability strategy with clear goals to advance our progress; hold ourselves accountable; and meet stakeholder expectations for environmental, social and governance commitments and performance. The strategy demonstrates our commitment to both a comprehensive definition of sustainability and progress across our key sustainability pillars — climate, consumption and community. Read our Sustainability Report, available on our website at www.levistrauss.com, for more information regarding our strategy and goals.* Set forth below are several key areas where we’re making progress.

| 90% absolute reduction in greenhouse Progress through 2021:

|  | 40% absolute reduction in supply Progress through 2021:

| |

| 100% renewable electricity in company-operated facilities by 2025 |  | “A-” score on the Carbon Disclosure Projects 2022 climate change survey | |

| Progress through 2021: 85% renewable electricity at our company-owned and operated facilities  85% 85% | ||||

Key Company Recognition

| Named third among the top five apparel companies globally |  | Acknowledged for the company’s work on leading the business community around gun violence prevention |  | Awarded for the company’s gun violence prevention work, specifically for rallying business leaders behind gun-safety legislation |  | Award for ourLevi’s® Circular501 jeans |

| * | Information contained on or accessible through our websites is not incorporated into, and does not form a part of, this Proxy Statement or any other report or document we file with the Securities and Exchange Commission, and any references to our websites are intended to be inactive textual references only. |

| 2023 PROXY STATEMENT | 3 |

DIVERSITY, EQUITY AND INCLUSION

In 2022, we launched our first-ever diversity, equity and inclusion (“DE&I”) Impact Report covering fiscal year 2021. The report reflects our commitment to fully and transparently communicate our progress in making our company more diverse and inclusive. Read our DE&I Impact Report, available on our website at www.levistrauss.com, for more information regarding our strategy and goals.* Set forth below are several key areas where we’re making progress.

| TRANSPARENT | We released our representation data for the first time in 2020 and committed to annual updates. Our 2021 data is currently available on our website. | ||

| We took several concrete steps to strengthen our position as a world-class destination for talent by: ● Launching a global self-identification initiative, which offers employees from key markets the opportunity to disclose additional aspects of their identity – including gender identity, disability status and sexual orientation ● Relaunching True Blue, our annual listening tour, with more affinity categories, including veterans, remote workers, and people with disabilities ● Re-vamping our internship experience making it more interactive and dynamic (F.I.T. = Fostering Intern Talent). ● Releasing our first-ever annual DEI Impact Report to continue our commitment to accountability, transparency and progress | |||

| PAY EQUITY | We conduct US pay equity audits every other year, under guidance from outside counsel, with the goal of maintaining fair and equitable compensation. Our studies in 2018, 2020, and 2022 found no systemic pay differences across gender or ethnicity. | ||

| EMPLOYEE RESOURCE GROUPS (ERG) | Our 15 ERGs serve as multicultural advisers to the company, create spaces of belonging, and are among our strongest retention and engagement programs. In 2021-22, we launched four new global ERGs: AMAzing Rivet, a women’s ERG in AMA and Rivet in Europe, Operation 501, a veteran’s ERG, and BeYou Alliance, an LGBTQ ERG in AMA. | ||

| INCLUSION AND ALLYSHIP | In 2022, we launched new HR policies for veterans and transgender employees, invested in inclusive facilities, and re-evaluated room names at The Plaza to ensure those they honor continue to represent our values. We recognized the LGBTQ+ community with a flag raising at The Plaza for Pride Month. |

| * | Information contained on or accessible through our websites is not incorporated into, and does not form a part of, this Proxy Statement or any other report or document we file with the Securities and Exchange Commission, and any references to our websites are intended to be inactive textual references only. |

| 4 | LEVI STRAUSS & CO. |

NOTICE OF 2023 ANNUAL MEETING

OF SHAREHOLDERS

| PROPOSALS | BOARD VOTE RECOMMENDATION | FOR FURTHER DETAILS | ||

| 1.Election of Class | “FOR” each director nominee | Page | ||

| 2. Advisory Vote on Executive Compensation | “FOR” | Page | ||

| 3. Ratification of Selection of Independent Registered Public Accounting Firm | “FOR” | Page |

Shareholders will also conduct any other business properly brought before the annual meeting or any adjournment or postponement thereof. A list of shareholders of record will be available for inspection by shareholders of record during normal business hours for ten10 days prior to the annual meeting for any legally valid purpose at our corporate headquarters at 1155 Battery Street, San Francisco, CA 94111. The shareholder list will also be available during the annual meeting at www.virtualshareholdermeeting.com/ LEVI2021.

Whether or not you expect to attend the annual meeting, you are urged to vote by proxy as promptly as possible to ensure your vote is counted. You may vote over the telephone, through the internet or by using the proxy card that you request as instructed in the Proxy Availability Notice. Even if you have voted by proxy, you may still vote at the annual meeting, as your proxy is revocable at your option. Note, however, that if your shares are held of record by a broker, bank or other agent and you wish to vote at the annual meeting, you must obtain a proxy issued in your name from that record holder. See the Proxy Availability Notice for more information.

By Order of the Board of Directors,

BLAIR MARKOVIC

CORPORATE SECRETARYCorporate Secretary

ATTENDANCE AT THE MEETING

A live webcast of the annual meeting will be available at www.virtualshareholdermeeting.com/LEVI2021.www. virtualshareholdermeeting.com/LEVI2023. To access the webcast, go to this website and follow the instructions provided. The webcast will be recorded and available for replay at this website through May 21, 2021.19, 2023. Electronic entry to the meeting will begin at 10:15 a.m., Pacific Time.

To attend, vote and submit questions during the annual meeting visit www.virtualshareholdermeeting.com/LEVI2021www.virtual shareholdermeeting.com/LEVI2023 and enter the 16-digit control number included in your Notice of InternetProxy Availability of Proxy Materials,Notice, voting instruction form or proxy card.

If you encounter difficulties accessing the virtual meeting, please call the technical support number that will be posted at www.virtualshareholdermeeting.com/LEVI2021.LEVI2023.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on April 19, 2023

The notice of annual meeting, proxy statement and annual report to shareholders are available free of charge at www.proxyvote.com.

| DATE AND TIME April 19, 2023 (Wednesday) 10:30 a.m. (Pacific Time) | ||

|

LEVI2023 | ||

| WHO CAN VOTE Shareholders as of February 24, 2023 are entitled to vote. | ||

|

| ||

|  |

| |

| INTERNET

| ||

| |||

|  | TELEPHONE

| |

| |||

|  |

| |

| |||

| AT THE VIRTUAL MEETING

| ||

| QR CODE

| ||

|

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting. Page references are supplied to help you find further information in this proxy statement.

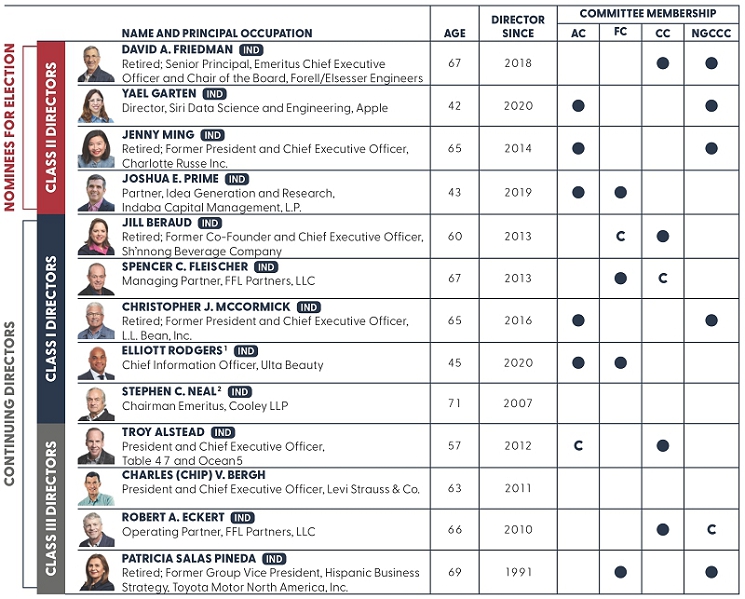

| PROPOSAL 1 | ELECTION OF CLASS The Board recommends a vote FOR each director nominee. | See page |

BOARD OF DIRECTORS

| DIRECTOR SINCE | COMMITTEE MEMBERSHIP | |||||||||

| NAME AND PRINCIPAL OCCUPATION | AGE | AC | FC | CHCC | NGCCC | |||||

|  |  | JILL BERAUD IND Retired; Former Chief Executive Officer, Ippolita | 62 | 2013 | C |  | |||

| SPENCER C. FLEISCHER IND Chairman, FFL Partners, LLC | 69 | 2013 |  | C | |||||

| CHRISTOPHER J. MCCORMICK IND Retired; Former President and Chief Executive Officer, L.L. Bean, Inc. | 67 | 2016 |  |  | |||||

| ELLIOTT RODGERS IND Executive Vice President and Chief Operations Officer, Foot Locker, Inc. | 47 | 2020 |  |  | |||||

|  |  | DAVID A. FRIEDMAN IND Retired; Senior Principal, Emeritus Chief Executive Officer and Chair of the Board, Forell/Elsesser Engineers | 69 | 2018 |  |  | |||

| YAEL GARTEN IND Director, AI/ML Data Science and Engineering, Apple | 44 | 2020 |  |  | |||||

| JENNY MING IND Retired; Former President and Chief Executive Officer, Charlotte Russe Inc. | 67 | 2014 |  |  | |||||

| JOSHUA E. PRIME IND Partner, Idea Generation and Research, Indaba Capital Management, L.P. | 45 | 2019 |  |  | |||||

|  | TROY M. ALSTEAD IND Founder and President, Table 47 and Ocean5 | 59 | 2012 | C |  | ||||

| CHARLES (“CHIP”) V. BERGH President and Chief Executive Officer, Levi Strauss & Co. | 65 | 2011 | |||||||

| ROBERT A. ECKERT IND Operating Partner, FFL Partners, LLC | 68 | 2010 |  | C | |||||

| MICHELLE GASS President, Levi Strauss & Co. | 54 | 2023 | |||||||

| PATRICIA SALAS PINEDA IND Retired; Former Group Vice President, Hispanic Business Strategy, Toyota Motor North America, Inc. | 71 | 1991 |  |  | |||||

| AC | Audit Committee | Compensation and Human Capital Committee |   |  | ||||

| FC | Finance Committee | NGCCC | Nominating, Governance and Corporate Citizenship Committee | C |

PROXY STATEMENT SUMMARY

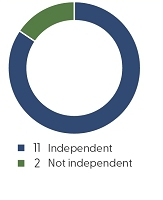

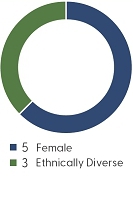

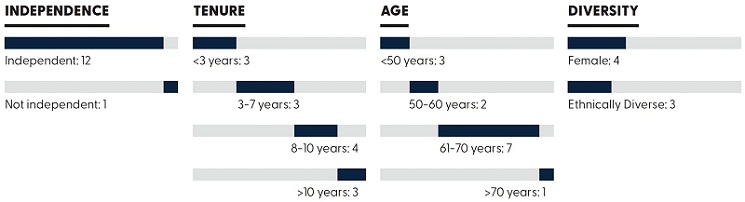

BOARD SNAPSHOT

| Independence | Tenure | Age | Diversity | |||

|  |  |  |

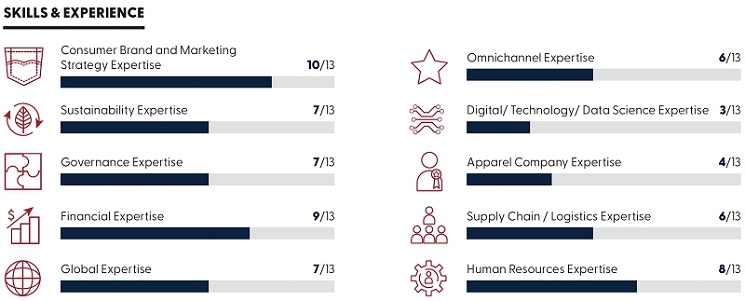

Skills & Experience

BOARD SNAPSHOT

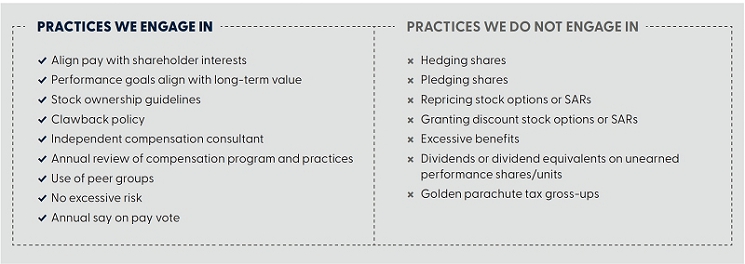

GOVERNANCE BEST PRACTICES

| ● | Independent Board Chair |

| ● | Majority of independent directors |

| ● | Diverse Board |

| ● | Committee membership limited to independent directors |

| ● | Executive sessions of non-employee directors of Board and committees |

| ● | Director and officer stock ownership requirements |

| ● | No poison pill |

|

PROXY STATEMENT SUMMARY

| PROPOSAL 2 | ADVISORY VOTE ON EXECUTIVE COMPENSATION The Board recommends a vote FOR this proposal. | See page |

FINANCIAL PERFORMANCE

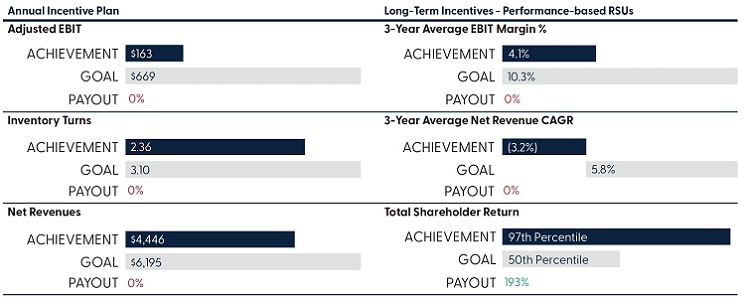

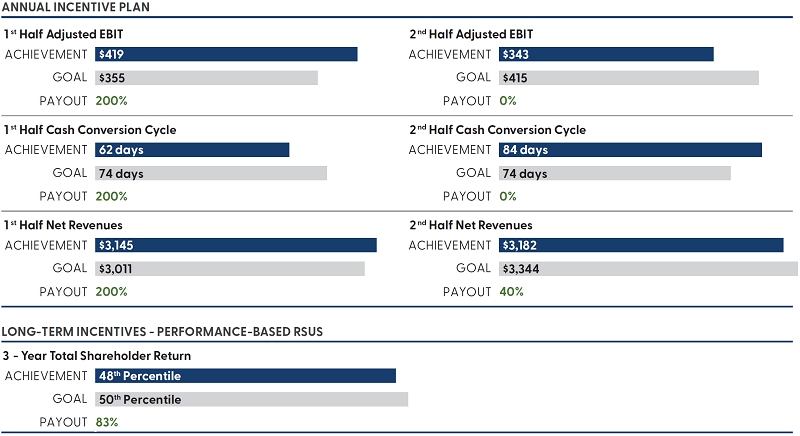

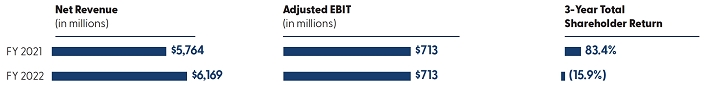

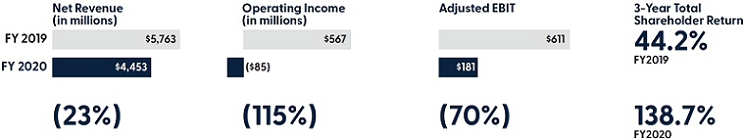

AlthoughThe company achieved another year of strong growth, including reported net revenue growth of 7% or an increase of 12% in constant currency.* We delivered these results, driving strong market share growth globally, despite facing a more challenging consumer environment in the second half of the year. Additionally, we returned $350 million to shareholders through share repurchases and dividends, an 84% increase over fiscal year 2020 was dominated by unprecedented challenges, resulting in financial results below the goals set at the beginning of the year, the company was able to make a number of measured and strategic adjustments to remain in a strong position for future growth and profitability. While our first quarter results were above expectations, global restrictions enacted due to the COVID-19 pandemic throughout the remainder of the year drove most key financial metrics well below where they had been in fiscal year 2019. Despite these challenges, the company achieved positive adjusted EBIT for the year and our cumulative 3-year total shareholder return was among the best in the retail industry.2021.

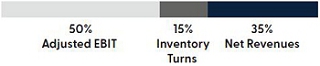

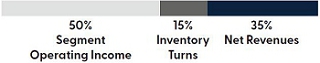

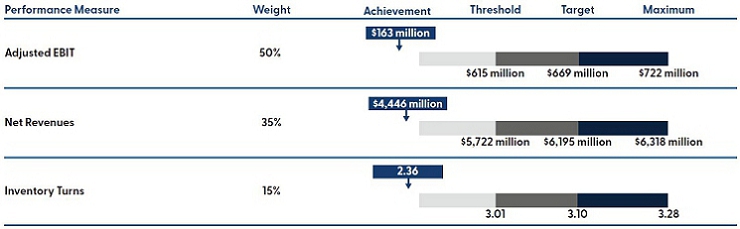

KEY PERFORMANCE MEASURES

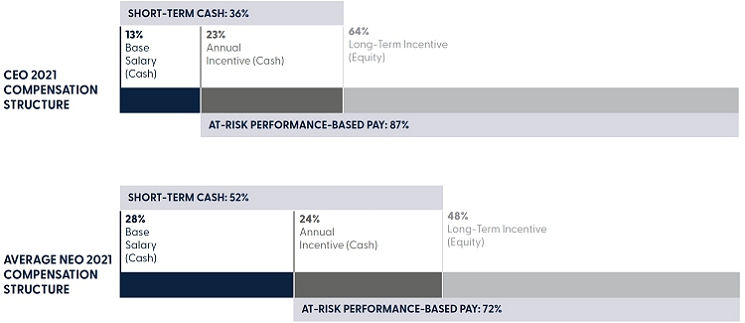

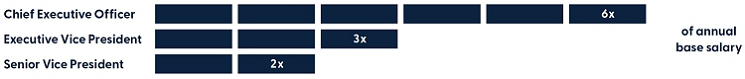

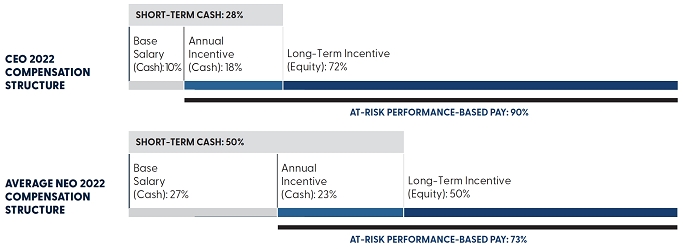

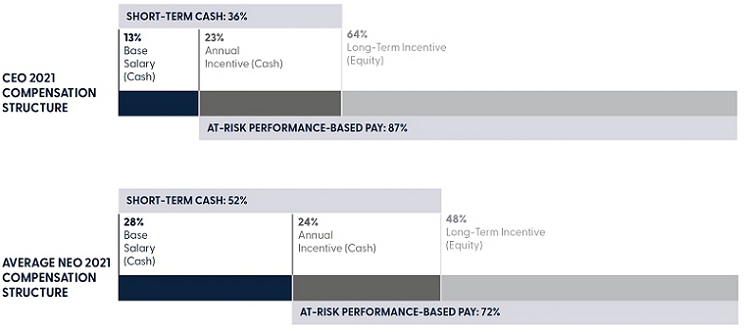

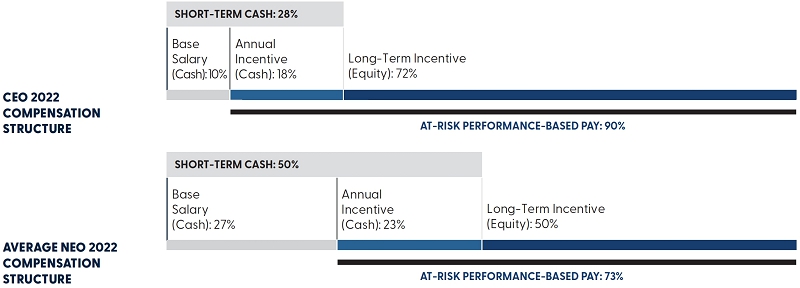

EXECUTIVE COMPENSATION HIGHLIGHTS

COMPENSATION SNAPSHOT

| * | We encourage you to review our Annual Report on Form 10-K for the year ended November 27, 2022. Constant-currency net revenues are not determined in accordance with accounting principles generally accepted in the United States (GAAP) and should not be viewed as a substitute for the most directly comparable GAAP measure. Constant-currency net revenues exclude the impact of foreign currency exchange rate fluctuations by translating local currency amounts in the comparison period at actual foreign exchange rates for the current period. Constant-currency net revenues of $5,512.2 for fiscal 2021 are calculated from reported net revenues of $5,763.9 million and exclude $251.7 million of impact from foreign currency exchange rates. |

PROXY STATEMENT SUMMARY

HIGH SAY ON PAY RESULTS

At the

| We held a shareholder advisory vote on executive compensation in |

| PROPOSAL 3 | RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Board recommends a vote FOR this proposal. | See page |

|

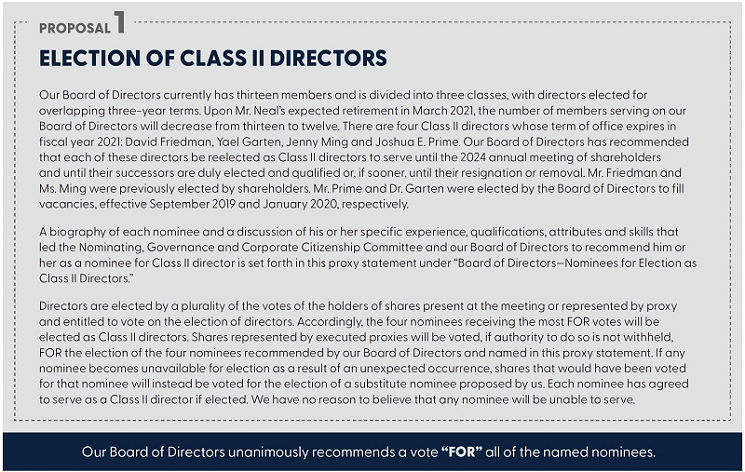

PROPOSAL 1

ELECTION OF CLASS II DIRECTORS

Our Board of Directors currently has thirteen members and is divided into three classes, with directors elected for overlapping three-year terms. Upon Mr. Neal’s expected retirement in March 2021, the number of members serving on our Board of Directors will decrease from thirteen to twelve. There are four Class II directors whose term of office expires in fiscal year 2021: David Friedman, Yael Garten, Jenny Ming and Joshua E. Prime. Our Board of Directors has recommended that each of these directors be reelected as Class II directors to serve until the 2024 annual meeting of shareholders and until their successors are duly elected and qualified or, if sooner, until their resignation or removal. Mr. Friedman and Ms. Ming were previously elected by shareholders. Mr. Prime and Dr. Garten were elected by the Board of Directors to fill vacancies, effective September 2019 and January 2020, respectively.

A biography of each nominee and a discussion of his or her specific experience, qualifications, attributes and skills that led the Nominating, Governance and Corporate Citizenship Committee and our Board of Directors to recommend him or her as a nominee for Class II director is set forth in this proxy statement under “Board of Directors—Nominees for Election as Class II Directors.”

Directors are elected by a plurality of the votes of the holders of shares present at the meeting or represented by proxy and entitled to vote on the election of directors. Accordingly, the four nominees receiving the most FOR votes will be elected as Class II directors. Shares represented by executed proxies will be voted, if authority to do so is not withheld, FOR the election of the four nominees recommended by our Board of Directors and named in this proxy statement. If any nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead be voted for the election of a substitute nominee proposed by us. Each nominee has agreed to serve as a Class II director if elected. We have no reason to believe that any nominee will be unable to serve.

Our Board of Directors unanimously recommends a vote “FOR” all of the named nominees.

Our

At each annual meeting of shareholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following their election and until their successors are duly elected and qualified. We expect that additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors.

Our corporate governance guidelines provide that directors are expected to attend our annual meetings of shareholders. All of our directors, except for Mr. Rodgers (who was elected after the annual meeting), attended the 2020 annual meeting of shareholders.

|

CORPORATE GOVERNANCE

The Board of Directors believes that it is in our best interests that the offices of CEO and Chair be held by separate individuals and, accordingly, our CEO and the Chair of our Board of Directors are currently separate individuals.

On March 26, 2021 we will transition the leadership of the Board. Mr. Neal will reach our mandatory Board of Directors retirement age of 72 and will step down from the Board of Directors. Mr. Eckert, who has been unanimously approved by the Board of Directors, will replace Mr. Neal as Chair of the Board.

Our corporate governance guidelines are available under the “Governance” tab of our website at investors.levistrauss.com.

Our Board of Directors seeks members who are committed to the values of our company and are, by reason of their character, judgment, knowledge and experience, capable of contributing to the effective governance of our company. In reaching this determination, our Board of Directors considers each candidate’s relevant expertise, accomplishments in his or her field, the ability to exercise sound business judgment and a commitment to rigorously represent the long-term interests of our shareholders. Our Board of Directors also considers diversity (including with respect to race, gender, geography and areas of expertise), age, skills and other factors that it deems appropriate to maintain a balance of knowledge, experience and capability. For an incumbent director whose term of office is set to expire, our Board of Directors reviews his or her overall service to the Company during the completed term, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair his or her independence. Our corporate governance guidelines provide that all directors are subject to a mandatory retirement age of 72, unless waived by our Board of Directors in its discretion.

NOMINEES FOR ELECTION AS CLASS II DIRECTORS

The following is a brief biography of each nominee for Class II director and a discussion of his or her specific experience, qualifications, attributes or skills that led the Nominating, Governance and Corporate Citizenship Committee and our Board of Directors to recommend him or her as a nominee for Class II director.

|

| |

CORPORATE GOVERNANCE

|

| |

|

| |

|

CORPORATE GOVERNANCE

|

| |

CONTINUING DIRECTORS

The following is a brief biography of each director whose term will continue after the annual meeting.

|

| |

CORPORATE GOVERNANCE

|

| |

|

| |

|

CORPORATE GOVERNANCE

|

| |

|

| |

CORPORATE GOVERNANCE

|

| |

|

| |

|

CORPORATE GOVERNANCE

|

| |

|

| |

CORPORATE GOVERNANCE

DIRECTOR SKILLS AND QUALIFICATIONS

The table below summarizes the key qualifications, skills, and attributes that our Board has determined are most relevant to service on our Board. A mark indicates a specific area of focus or expertise on which the Board particularly relies. Not having a mark does not mean the director does not possess that qualification or skill. Our directors’ biographies describe each director’s background and relevant experience in more detail.

|  |  |  |  |  |  |  |  |  |  | ||||||||||||||||||

|  |  |  |  |  |  |  | |||||||||||||||||||||

|  |  |  |  |  |  |  | |||||||||||||||||||||

|  |  |  |  |  |  |  |  |  | |||||||||||||||||||

|  |  |  |  |  |  |  | |||||||||||||||||||||

|  |  |  |  |  |  | ||||||||||||||||||||||

|  |  |  | |||||||||||||||||||||||||

|  |  |  |  | ||||||||||||||||||||||||

|  |  |  |  |  |  | ||||||||||||||||||||||

|  |  |  |  |  |  |  |  |

|

CORPORATE GOVERNANCE

IDENTIFICATION AND CONSIDERATION OF NEW NOMINEES

The Nominating, Governance and Corporate Citizenship Committee believes that candidates for director should have certain minimum qualifications, including the ability to read and understand basic financial statements and having the highest personal integrity and ethics. The Nominating, Governance and Corporate Citizenship Committee also will consider factors such as whether a director nominee possesses relevant expertise upon which to be able to offer advice and guidance to management, has sufficient time to devote to the affairs of the Company, demonstrates excellence in his or her field, has the ability to exercise sound business judgment and has the commitment to rigorously represent the long-term interests of the Company’s shareholders. However, the Nominating, Governance and Corporate Citizenship Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board, our operating requirements and the long-term interests of shareholders. In conducting this assessment, the Nominating, Governance and Corporate Citizenship Committee typically considers diversity, age, skills and such other factors as it deems appropriate, given the current needs of us and the Board, to maintain a balance of knowledge, experience and capability.

SHAREHOLDER NOMINATIONS

The Nominating, Governance and Corporate Citizenship Committee will consider director candidates recommended by shareholders. The Nominating, Governance and Corporate Citizenship Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a shareholder. Shareholders who wish to recommend individuals for consideration by the Nominating, Governance and Corporate Citizenship Committee to become nominees for election to our Board of Directors may do so by delivering a written recommendation to the Nominating, Governance and Corporate Citizenship Committee at 1155 Battery Street, San Francisco, CA 94111 in accordance with the procedures set forth in our bylaws. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

As required by New York Stock Exchange (“NYSE”) listing standards, a majority of the members of a listed company’s Board of Directors must qualify as “independent,” as affirmatively determined by the Board of Directors. Our Board of Directors consults with counsel to ensure that its determinations are consistent with relevant securities and other laws and regulations regarding the definition of independent, including those set forth in applicable NYSE listing standards, as in effect from time to time. In addition, the charters of the committees of our Board of Directors prohibit members from having any relationship that would interfere with the exercise of their independence from management and our company. The fact that a director may own our capital stock is not, by itself, considered an interference with independence under these charters.

Consistent with these considerations, after review of all relevant identified transactions or relationships between each director, or any of his or her family members, and our company, senior management and our independent auditors, our Board of Directors has affirmatively determined that all of our directors are independent, with the exception of Mr. Bergh, who serves as our President and CEO.

Each of Mr. Friedman and Mr. Prime, either directly or by marriage, is a descendant of the family of our founder, Levi Strauss.

CORPORATE GOVERNANCE

COMMITTEE MEMBERSHIP AND STRUCTURE

Our Board of Directors has established four standing committees: an Audit Committee, a Finance Committee, a Compensation Committee, and a Nominating, Governance and Corporate Citizenship Committee, each of which has the composition and responsibilities described below. From time to time, our Board of Directors may establish other committees to facilitate the management of our business. Below is a description of each committee of our Board of Directors.

|

|

|

|

|

CORPORATE GOVERNANCE

|

|

|

|

CORPORATE GOVERNANCE

Our Board of Directors met ten times during the last fiscal year. Each director attended 75% or more of the aggregate number of meetings of the Board and of the committees on which he or she served, held during the portion of the last fiscal year for which he or she was a director or committee member.

In accordance with our corporate governance guidelines and applicable NYSE listing standards, executive sessions of non-management directors are scheduled for every meeting of our Board of Directors and at such other times as our non-management directors see fit. All executive sessions of non-management directors are presided over by the Chair of our Board of Directors. In the absence of the Chair of our Board of Directors, the participating non-management directors will select a director to preside over an executive session. If our non-management directors include directors who are not independent, then at least once per year, our independent directors will meet in an executive session.

| 10 | LEVI STRAUSS & CO. |

Our Board of Directors has 13 members. Our current Board of Directors is divided into three classes with directors elected for overlapping three-year terms:

| ● | The term for directors in Class I (Jill Beraud, Spencer C. Fleischer, Christopher J. McCormick, and Elliott Rodgers) will end at the 2023 annual meeting of shareholders; |

| ● | The term for directors in Class II (David A. Friedman, Yael Garten, Jenny Ming and Joshua E. Prime) will end at the 2024 annual meeting of shareholders; and |

| ● | The term for directors in Class III (Troy M. Alstead, Charles (“Chip”) V. Bergh, Robert A. Eckert, Michelle Gass and Patricia Salas Pineda) will end at the 2025 annual meeting of shareholders. |

At each annual meeting of shareholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following their election and until their successors are duly elected and qualified or, if sooner, their death, resignation or removal. We expect that additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors.

Our corporate governance guidelines provide that directors are expected to attend our annual meetings of shareholders. All of our then-serving directors attended the 2022 annual meeting of shareholders.

| 2023 PROXY STATEMENT | 11 |

CORPORATE GOVERNANCE

The Board of Directors believes that it is in the best interests of the company and its shareholders to separate the Chair of the Board and Chief Executive Officer roles and for our Chair to be independent. Currently, Mr. Eckert serves as our independent Chair of the Board.

Our corporate governance guidelines are available under the “Governance” tab of our website at investors.levistrauss.com.

Our Board of Directors seeks members who are committed to the values of our company and are, by reason of their character, judgment, knowledge and experience, capable of contributing to the effective governance of our company.

In reaching this determination, our Board of Directors considers, among other things, each candidate’s:

| ● | relevant expertise; | |

| ● | excellence in his or her field; | |

| ● | the ability to exercise sound business judgment; and | |

| ● | commitment to rigorously represent the long-term interests of our shareholders. |

Our Board of Directors also considers diversity (including with respect to race, gender, geography, sexual orientation and areas of expertise), age, skills and other factors that it deems appropriate to maintain a balance of knowledge, experience and capability. The Board is committed to actively seeking out diverse candidates, including qualified women and individuals from minority and other groups described above, to include in the pool from which nominees for the Board are selected.

For an incumbent director whose term of office is set to expire, our Board of Directors reviews his or her overall service to the company during the completed term, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair his or her independence.

Our corporate governance guidelines provide that all directors are subject to a mandatory retirement age of 72, unless waived by our Board of Directors in its discretion.

| 12 | LEVI STRAUSS & CO. |

CORPORATE GOVERNANCE

NOMINEES FOR ELECTION AS CLASS I DIRECTORS

The following is a brief biography of each nominee for Class I director and a discussion of his or her specific experience, qualifications, attributes or skills that led the Nominating, Governance and Corporate Citizenship Committee and our Board of Directors to recommend him or her as a nominee for Class I director.

| JILL BERAUD Retired; Former Chief Executive Officer, Ippolita | ||

AGE: 62 DIRECTOR SINCE: 2013 | COMMITTEES: | Finance Committee (Chair), Compensation and Human Capital Committee | |

CAREER HIGHLIGHTS:

| ● | Retired Chief Executive Officer of Ippolita, a privately held luxury jewelry company with distribution in high-end department stores, flagship and ecommerce, from October 2015 until September 2018. |

| ● | Executive Vice President for Tiffany & Co., with responsibility for its Global Retail Operations and E-Commerce with oversight of strategic store development and real estate from October 2014 until June 2015. |

| ● | Served as Chief Executive Officer for Living Proof, Inc., a privately held company that uses advanced medical and materials technologies to create hair care and skin care products for women from December 2011 to October 2014. |

| ● | Served as President of Starbucks/Lipton Joint Ventures and Chief Marketing Officer of PepsiCo Americas Beverages from July 2009 to June 2011, and PepsiCo’s Global Chief Marketing Officer from December 2008 to July 2009. |

| ● | Spent 13 years at Limited Brands in various roles, including Chief Marketing Officer of Victoria’s Secret and Executive Vice President of Marketing for its broader portfolio of specialty brands, including Bath & Body Works, C.O. Bigelow, Express, Henri Bendel and Limited Stores. |

| ● | Director of Revance Therapeutics, Inc., Chair of the Board for the Fashion for Good BV and serves on the Board of Governors for The World of Children non-profit organization. |

KEY QUALIFICATIONS:

Ms. Beraud was selected to join our Board of Directors due to her extensive marketing, social media and consumer branding experience, as well as her extensive managerial and operational knowledge in the apparel and other consumer goods industries.

| Chairman, FFL Partners, LLC | ||

DIRECTOR SINCE: 2013 | COMMITTEES: | Compensation and Human Capital Committee (Chair), Finance Committee | |

CAREER HIGHLIGHTS:

| ● | Current Chairman and former Managing Partner of FFL Partners, LLC, a private equity firm. |

| ● | Spent 19 years at Morgan Stanley & Company as an investment banker and senior leader, leading business units in Asia, Europe and the United States, before co-founding FFL Partners, LLC in 1997. |

| ● | Currently serves as a director of The Clorox Company and Americans for Oxford, Inc. |

KEY QUALIFICATIONS:

Mr. Fleischer was selected to join our Board of Directors due to his broad financial and international business perspectives developed over many years in the private equity and investment banking industries.

| 2023 PROXY STATEMENT | 13 |

CORPORATE GOVERNANCE

| CHRISTOPHER J. MCCORMICK Retired; Former President and Chief Executive Officer, L.L. Bean, Inc | ||

AGE: 67 DIRECTOR SINCE: 2016 | COMMITTEES: | Audit Committee, Nominating, Governance and Corporate Citizenship Committee | |

CAREER HIGHLIGHTS:

| ● | Served as President and Chief Executive Officer of L.L. Bean, Inc. from 2001 until 2016. |

| ● | Senior Vice President and Chief Marketing Officer of L.L. Bean from 2000 to 2001. |

| ● | Joined L.L. Bean in 1983, previously serving in a number of senior and executive level positions in advertising and marketing. |

| ● | Director of Big Lots!, Inc. and a former director of Sun Life Financial, Inc. |

KEY QUALIFICATIONS:

Mr. McCormick brings to our Board of Directors his deep channel knowledge and ecommerce and direct marketing experience.

| ELLIOTT RODGERS Executive Vice President and Chief Operations Officer, Foot Locker, Inc. | ||

AGE: 47 DIRECTOR SINCE: 2020 | COMMITTEES: | Audit Committee, Finance Committee | |

CAREER HIGHLIGHTS:

| ● | Executive Vice President and Chief Operations Officer at Foot Locker, Inc. since December 2022. |

| ● | Chief People Officer at project44, a supply chain visibility platform from October 2021 to December 2022 |

| ● | Previously was Chief Information Officer and Chief Supply Chain Officer of Ulta Beauty. Joined Ulta Beauty in 2013 and served in a number of senior positions where he led distribution, transportation, supplier operations, sales and operations planning, and supply chain strategy. |

| ● | Led the transformation of Ulta Beauty’s supply chain in support of its strategic imperatives. |

| ● | Held operational leadership roles spanning retail, financial services, and logistics at Target, Citibank and the United States Army. |

| ● | Served in various assignments as an Army Officer, including leading logistics support operations for humanitarian service missions. |

KEY QUALIFICATIONS:

Mr. Rodgers was selected to join our Board of Directors due to his broad professional experience and his extensive operational, technology and retail leadership experience.

| 14 | LEVI STRAUSS & CO. |

CORPORATE GOVERNANCE

CONTINUING DIRECTORS

The following is a brief biography of each director whose term will continue after the annual meeting.

| TROY M. ALSTEAD Founder and President, Table 47, Ocean5, and The Cup Coffee Lounge | ||

AGE: 59 DIRECTOR SINCE: 2012 | COMMITTEES: | Audit Committee (Chair), Compensation and Human Capital Committee | |

CAREER HIGHLIGHTS:

| ● | Founder and President of Table 47, Ocean5, a restaurant and social concept, and The Cup Coffee Lounge. |

| ● | Retired from Starbucks Corporation in February 2016 after 24 years with the company, having most recently served as Chief Operating Officer. |

| ● | Held the positions of Group President, Chief Financial Officer and Chief Administrative Officer of Starbucks. |

| ● | Spent a decade in Starbucks international business, including roles as Senior Leader of Starbucks International, President of Europe, Middle East and Africa headquartered in Amsterdam and Chief Operating Officer of Starbucks Greater China headquartered in Shanghai. |

| ● | Currently serves as a director of Harley-Davidson, Inc., Array Technologies, Inc., and OYO Global. |

KEY QUALIFICATIONS:

Mr. Alstead brings to our Board of Directors his broad financial and business perspective developed over many years in the global consumer goods industry.

| CHARLES (“CHIP”) V. BERGH President and Chief Executive Officer, Levi Strauss & Co. | ||

AGE: 65 DIRECTOR SINCE: 2011 | COMMITTEES: | None | |

CAREER HIGHLIGHTS:

| ● | President and Chief Executive Officer of Levi Strauss & Co. |

| ● | Joined LS&Co. after a distinguished career at Procter & Gamble. His last assignment was leading the Gillette integration following P&G’s $57 billion acquisition of that business and running the Gillette Blades & Razors business and the entire Male Grooming portfolio of P&G. |

| ● | Twenty-eight-year career at P&G included roles of increasing scope and complexity and included a six-year assignment as Regional President of Southeast Asia, India and Australia. |

| ● | Currently serves as the non-executive Chairman of HP Inc. |

| ● | Previously served on the Board of Directors for VF Corporation, the Singapore Economic Development Board and was a member of the US ASEAN Business Council, Singapore. |

KEY QUALIFICATIONS:

Mr. Bergh’s position as our President and Chief Executive Officer and his past experience as a leader of large, global consumer brands make him well suited to be a member of our Board of Directors.

| 2023 PROXY STATEMENT | 15 |

CORPORATE GOVERNANCE

| ROBERT A. ECKERT Operating Partner, FFL Partners, LLC | ||

AGE: 68 DIRECTOR SINCE: 2010 | COMMITTEES: | Nominating, Governance and Corporate Citizenship Committee (Chair), Compensation and Human Capital Committee | |

CAREER HIGHLIGHTS:

| ● | Chair of our Board of Directors, a position he has held since 2021. |

| ● | Operating Partner of FFL Partners, LLC, a private equity firm, since September 2014. |

| ● | Chairman Emeritus of Mattel, Inc., a role he has held since January 2013. |

| ● | Chairman and Chief Executive Officer of Mattel from May 2000 until December 2011, and he continued to serve as its Chairman until December 2012. |

| ● | Previously worked for Kraft Foods, Inc. for 23 years, and served as President and Chief Executive Officer from October 1997 until May 2000. |

| ● | Group Vice President of Kraft Foods from 1995 to 1997, and President of the Oscar Mayer foods division of Kraft Foods from 1993 to 1995. |

| ● | Currently a director of McDonald’s Corporation, Uber Technologies, Inc., Amgen, Inc., Eyemart Express Holdings, LLC and Quinn Group Inc. |

KEY QUALIFICATIONS:

Mr. Eckert was selected to join our Board of Directors due to his experience as a senior executive engaged with the dynamics of building global consumer brands through high performance expectations, integrity and decisiveness in driving businesses to successful results.

| DAVID A. FRIEDMAN Retired; Former Senior Principal, Emeritus Chief Executive Officer and past-Chair of the Board, Forell/Elsesser Engineers | ||

AGE: 69 DIRECTOR SINCE: 2018 | COMMITTEES: | Compensation and Human Capital Committee, Nominating, Governance and Corporate Citizenship Committee | |

CAREER HIGHLIGHTS:

| ● | Retired Senior Principal, Emeritus Chief Executive Officer and past-Chair of the Board, and past President and Chief Executive Officer of Forell/Elsesser Engineers, with over 40 years of professional practice in structural and earthquake engineering. |

| ● | President and member of the Board of Directors for the Earthquake Engineering Research Institute, which disseminates lessons learned from earthquakes around the world, and served on its post-earthquake reconnaissance teams in Kobe, Japan in 1995 and Wenchuan, China in 2008. |

| ● | Involved in many institutional, academic, philanthropic and not-for-profit boards, including the San Francisco Foundation, the San Francisco Planning and Urban Research Association, the University of California, Berkeley Foundation, the Jewish Home of San Francisco and GeoHazards International. |

| ● | A licensed structural engineer in California, Nevada and British Columbia. |

KEY QUALIFICATIONS:

Mr. Friedman was selected to join our Board of Directors due to his broad professional experience, as well as his extensive background with our company arising from his familial connection to our founder.

| 16 | LEVI STRAUSS & CO. |

CORPORATE GOVERNANCE

| YAEL GARTEN Director, AI/ML Data Science and Engineering, Apple | ||

AGE: 44 DIRECTOR SINCE: 2020 | COMMITTEES: | Audit Committee, Nominating, Governance and Corporate Citizenship Committee | |

CAREER HIGHLIGHTS:

| ● | Director, AI/ML Data Science and Engineering, Apple, Inc. since August 2017. |

| ● | Worked at LinkedIn Corporation in a number of positions from October 2011 to August 2017, including as Director of Data Science from October 2015 to August 2017. |

| ● | Research Scientist and Text Mining Lead at Stanford University School of Medicine before joining LinkedIn. |

KEY QUALIFICATIONS:

Dr. Garten was selected to join our Board of Directors for her expertise in data science, artificial intelligence and machine learning, and converting data into actionable product and business strategy. She has applied this expertise across products and services with massive global user bases.

| MICHELLE GASS President, Levi Strauss & Co. | ||

AGE: 55 DIRECTOR SINCE: 2023 | COMMITTEES: | None | |

CAREER HIGHLIGHTS:

| ● | President of Levi Strauss & Co. since January 2023. |

| ● | Previously Chief Executive Officer of Kohl’s Corporation from May 2018 until December 2022 where she led the company’s effort to become a leading omnichannel retailer while acquiring and elevating notable national brand partnerships, including the long-term partnership with Sephora. Held positions of Chief Merchandising and Customer Officer and Chief Customer Officer at Kohl’s prior to becoming Chief Executive Officer. |

| ● | Served in a variety of leadership roles at Starbucks Corporation across marketing, global strategy, and merchandising for more than 16 years, including President, Starbucks Europe, Middle East and Africa and Executive Vice President, Marketing and Category. |

| ● | Served in product development and brand management roles at Procter and Gamble before joining Starbucks. |

| ● | Serves on the Board of Directors of PepsiCo, Inc. |

KEY QUALIFICATIONS:

Ms. Gass’ position as our President and her deep retail and omni-channel experience combined with her track record of building brands and meaningful innovation make her well suited to serve as a member of our Board of Directors.

| 2023 PROXY STATEMENT | 17 |

CORPORATE GOVERNANCE

| JENNY MING Retired; Former President and Chief Executive Officer, Charlotte Russe Inc. | ||

AGE: 67 DIRECTOR SINCE: 2014 | COMMITTEES: | Audit Committee, Nominating, Governance and Corporate Citizenship Committee | |

CAREER HIGHLIGHTS:

| ● | President and Chief Executive Officer of Charlotte Russe Inc., a fast-fashion specialty retailer of apparel and accessories catering to young women, from October 2009 to February 2019. In February 2019, Charlotte Russe Inc. filed a voluntary petition under Chapter 11 of the U.S. Bankruptcy Code. |

| ● | Was a member of Gap Inc.’s executive team that launched Old Navy, a $7 billion brand in Gap Inc.’s portfolio. Served as its first President from March 1999 to October 2006, where she oversaw all aspects of Old Navy and its 900 retail clothing stores in the United States and Canada. |

| ● | Joined Gap Inc. in 1986, serving in various executive capacities at its San Francisco headquarters. |

| ● | Serves on the Board of Directors of Affirm Holdings, Inc., Kendra Scott, LLC, Rothy’s, Inc. and Kaiser Hospital Health Plan. Former director of Poshmark, Inc. |

KEY QUALIFICATIONS:

Ms. Ming was selected to join our Board of Directors due to her extensive operational and retail leadership experience in the apparel industry.

| PATRICIA SALAS PINEDA Retired; Former Group Vice President, Hispanic Business Strategy, Toyota Motor North America, Inc. | ||

AGE: 71 DIRECTOR SINCE: 1991 | COMMITTEES: | Finance Committee, Nominating, Governance and Corporate Citizenship Committee | |

CAREER HIGHLIGHTS:

| ● | Retired in October 2016 as Group Vice President of Hispanic Business Strategy for Toyota Motor North America, Inc., an affiliate of one of the world’s largest automotive firms, a position she held since May 2013. |

| ● | Served Toyota Motor North America as Group Vice President of National Philanthropy and the Toyota USA Foundation from 2004 to 2013. |

| ● | Served Toyota Motor North America as General Counsel and Group Vice President of Administration from 2006 to 2008 and as Group Vice President of Corporate Communications and General Counsel from 2004 to 2006. |

| ● | Prior to joining Toyota, served as Vice President of Legal, Human Resources and Government Relations, and Corporate Secretary of New United Motor Manufacturing, Inc. with which she had been associated since 1984. |

| ● | Currently a director of Frontier Group Holdings, Inc., Omnicom Group Inc., Portland General Electric, Chairwoman Emeritus and a board member of the Latino Corporate Directors Association and a member of the board of trustees of Earthjustice. |

KEY QUALIFICATIONS:

Ms. Pineda was selected as a member of our Board of Directors to bring her expertise in government relations and regulatory oversight, corporate governance and human resources matters. Her long tenure on our Board of Directors also provides valuable historical perspective.

| 18 | LEVI STRAUSS & CO. |

CORPORATE GOVERNANCE

| JOSHUA E. PRIME Partner, Idea Generation and Research, Indaba Capital Management, L.P. | ||

AGE: 45 DIRECTOR SINCE: 2019 | COMMITTEES: | Audit Committee, Finance Committee | |

CAREER HIGHLIGHTS:

| ● | Partner, Idea Generation and Research, at Indaba Capital Management, L.P., where he has served since its founding in 2010. |

| ● | Manager of retail strategy for the Americas Region of Levi Strauss & Co. from 2007 to 2009. |

| ● | Served as an analyst in merger arbitrage, special situations and credit at Farallon Capital Management, L.L.C. from 1999 to 2005. |

KEY QUALIFICATIONS:

Mr. Prime was selected to join our Board of Directors due to his broad professional experience, including with our company, and his extensive background with the company arising from his familial connection to our founder.

| 2023 PROXY STATEMENT | 19 |

CORPORATE GOVERNANCE

DIRECTOR SKILLS AND QUALIFICATIONS

The table below summarizes the key qualifications, skills and attributes that our Board has determined are most relevant to service on our Board. A mark next to a qualification or skill indicates a specific area of focus or expertise on which the Board particularly relies. Not having a mark does not mean the director does not possess that qualification or skill. Our directors’ biographies describe each director’s background and relevant experience in more detail.

|  |  |  |  |  |  |  |  |  |  |  |  | ||||||||||||||||

| Consumer Brand and Marketing Strategy | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||

| Corporate Citizenship / Sustainability | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||||||

| Governance | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||

| Financial | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||||

| Global | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||||||

| Omnichannel | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||

| Digital / Technology / Data Science / Cybersecurity | ● | ● | ● | ● | ● | ||||||||||||||||||||||

| Apparel | ● | ● | ● | ● | ● | ||||||||||||||||||||||

| Supply Chain / Logistics | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||

| Human Resources | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||||

| Gender Diversity Individuals who self-identify as female | ● | ● | ● | ● | ● | ||||||||||||||||||||||

| Racial Diversity Individuals who self-identify as Black, African American, Hispanic, Latinx, Asian, Pacific Islander, Native American, Native Hawaiian, or Alaska Native. | ● | ● | ● |

| 20 | LEVI STRAUSS & CO. |

CORPORATE GOVERNANCE

IDENTIFICATION AND CONSIDERATION OF NEW NOMINEES

The Nominating, Governance and Corporate Citizenship Committee believes that candidates for director should have certain minimum qualifications, including the ability to read and understand basic financial statements and having the highest personal integrity and ethics. The Nominating, Governance and Corporate Citizenship Committee also will consider factors such as whether a director nominee possesses relevant expertise upon which to be able to offer advice and guidance to management, has sufficient time to devote to the affairs of the company, demonstrates excellence in his or her field, has the ability to exercise sound business judgment and has the commitment to rigorously represent the long-term interests of the company’s shareholders. However, the Nominating, Governance and Corporate Citizenship Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board, our operating requirements and the long-term interests of shareholders. In conducting this assessment, the Nominating, Governance and Corporate Citizenship Committee typically considers diversity, age, skills and such other factors as it deems appropriate, given the current needs of us and the Board, to maintain a balance of knowledge, experience and capability.

The Nominating, Governance and Corporate Citizenship Committee will consider director candidates recommended by shareholders. The Nominating, Governance and Corporate Citizenship Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a shareholder. Shareholders who wish to recommend individuals for consideration by the Nominating, Governance and Corporate Citizenship Committee to become nominees for election to our Board of Directors may do so by delivering a written recommendation to the Nominating, Governance and Corporate Citizenship Committee at 1155 Battery Street, San Francisco, CA 94111 in accordance with the procedures set forth in our bylaws. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

DIRECTOR INDEPENDENCE

As required by New York Stock Exchange (“NYSE”) listing standards, a majority of the members of a listed company’s Board of Directors must qualify as “independent,” as affirmatively determined by the Board of Directors. Our Board of Directors consults with counsel to ensure that its determinations are consistent with relevant securities and other laws and regulations regarding the definition of independent, including those set forth in applicable NYSE listing standards, as in effect from time to time. In addition, the charters of the committees of our Board of Directors prohibit members from having any relationship that would interfere with the exercise of their independence from management and our company. The fact that a director may own our capital stock is not, by itself, considered an interference with independence under these charters.

Consistent with these considerations, after review of all relevant identified transactions or relationships between each director, or any of his or her family members, and our company, senior management and our independent auditors, our Board of Directors has affirmatively determined that all of our directors are independent, with the exception of Mr. Bergh and Ms. Gass, who serve as executive officers.

Each of Mr. Friedman and Mr. Prime, either directly or by marriage, is a descendant of the family of our founder, Levi Strauss.

COMMITTEE MEMBERSHIP AND STRUCTURE

Our Board of Directors has established four standing committees: an Audit Committee, a Finance Committee, a Compensation and Human Capital Committee, and a Nominating, Governance and Corporate Citizenship Committee, each of which has the composition and responsibilities described below. From time to time, our Board of Directors may establish other committees to facilitate the management of our business. Below is a description of each committee of our Board of Directors.

| 2023 PROXY STATEMENT | 21 |

CORPORATE GOVERNANCE

AUDIT COMMITTEE

MEETINGS IN FISCAL YEAR 2022: 8

| MEMBERS: | |||||||||||||

| TROY M. ALSTEADCHAIR |  |  |  |  |  | |||||||

| Yael Garten | Christopher J. McCormick | Jenny Ming | Joshua E. Prime | Elliott Rodgers | |||||||||

PRIMARY RESPONSIBILITIES:

| ● | Provides assistance to our Board of Directors in its oversight of the integrity of our financial statements and ESG disclosures, financial reporting processes, internal controls systems and compliance with legal requirements. |

| ● | Meets with our management regularly to discuss our critical accounting policies, internal controls and financial reporting process and our financial reports to the public. |

| ● | Meets with our independent registered public accounting firm and with our financial personnel and internal auditors regarding these matters. |

| ● | Examines the independence and performance of our internal auditors and our independent registered public accounting firm. |

| ● | Has sole and direct authority to engage, appoint, evaluate and replace our independent auditor. Both our independent registered public accounting firm and our internal auditors regularly meet privately with, and have unrestricted access to, the Audit Committee. |

Our Board of Directors has determined that each member of the Audit Committee satisfies the independence requirements for Audit Committee members under the listing standards of the NYSE and Rule 10A-3 of the Exchange Act and meets the financial literacy requirements under the rules and regulations of the NYSE and the U.S. Securities and Exchange Commission (“SEC”). Mr. Alstead has been determined to be an “audit committee financial expert” as defined by SEC rules.

The Audit Committee operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of the NYSE. This charter is available under the “Governance” tab of our website at investors.levistrauss.com.

FINANCE COMMITTEE

MEETINGS IN FISCAL 2022: 7

| MEMBERS: | |||||||||||

| JILL BERAUDCHAIR |  |  |  |  | ||||||

| Spencer C. Fleischer | Patricia Salas Pineda | Joshua E. Prime | Elliott Rodgers | ||||||||

PRIMARY RESPONSIBILITIES:

| ● | Provides assistance to our Board of Directors in its oversight of our financial condition and management, financing strategies and execution and relationships with shareholders, creditors and other members of the financial community. |

| ● | Reviews and makes recommendations to the Board regarding dividends, share repurchases and other sources of shareholder liquidity. |

| ● | Evaluates potential acquisition or investment opportunities. |

| ● | Reviews capital returns from various aspects of operations. |

The Finance Committee operates under a written charter, which is available under the “Governance” tab of our website at investors.levistrauss.com.

| 22 | LEVI STRAUSS & CO. |

CORPORATE GOVERNANCE

COMPENSATION AND HUMAN CAPITAL COMMITTEE

MEETINGS IN FISCAL YEAR 2022: 5

| MEMBERS: | |||||||||||

| SPENCER C. FLEISCHERCHAIR |  |  |  |  | ||||||

| Troy M. Alstead | Jill Beraud | Robert A. Eckert | David A. Friedman | ||||||||

PRIMARY RESPONSIBILITIES:

| ● | Provides assistance to our Board of Directors in its oversight of our compensation, benefits and human resources programs and of senior management performance, composition and compensation. |

| ● | Reviews our compensation objectives and performance against those objectives, reviews market conditions and practices and our strategy and processes for making compensation decisions and approves (or, in the case of our CEO, recommends to our Board of Directors) the annual and long-term compensation for our executive officers, including our long-term incentive compensation plans. |

| ● | Reviews our succession planning process for all our senior executives, including our CEO. |

| ● | Reviews with management our Compensation Discussion and Analysis and considers whether to recommend that it be included in our SEC filings. |

| ● | Reviews our policies and strategies relating to culture, recruiting, retention, career development and progression, talent planning, and diversity and inclusion. |

| ● | Reviews the compensation and benefits of our non-employee directors. |

Our Board of Directors has determined that each member of the Compensation and Human Capital Committee is a non-employee member of our Board of Directors as defined in Rule 16b-3 under the Exchange Act and an outside director as defined in Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). The composition of the Compensation and Human Capital Committee meets the requirements for independence under the current listing standards of the NYSE and current SEC rules and regulations.

The Compensation and Human Capital Committee operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of the NYSE. Under this charter, the Compensation and Human Capital Committee may, in its discretion, delegate its duties to a subcommittee. This charter is available under the “Governance” tab of our website at investors.levistrauss.com.

The specific determinations of the Compensation and Human Capital Committee with respect to executive compensation for fiscal year 2022 are described in greater detail under “Compensation Discussion and Analysis.”

NOMINATING, GOVERNANCE AND CORPORATE CITIZENSHIP COMMITTEE

MEETINGS IN 2022: 5

| MEMBERS: | |||||||||||||

| ROBERT A. ECKERTCHAIR |  |  |  |  |  | |||||||

| David A. Friedman | Yael Garten | Christopher J. McCormick | Jenny Ming | Patricia Salas Pineda | |||||||||

PRIMARY RESPONSIBILITIES:

| ● | Responsible for identifying qualified candidates for, and making recommendations regarding the size and composition of, our Board of Directors in light of, among other factors, directors’ skills, experience, independence and availability of service. |

| ● | Responsible for overseeing our corporate governance matters, reporting and making recommendations to our Board of Directors concerning corporate governance matters, and reviewing the performance of the Chair of our Board of Directors and our CEO. |

| 2023 PROXY STATEMENT | 23 |

CORPORATE GOVERNANCE

| ● | Oversees the annual self-evaluations of the Board and its committees and makes recommendations concerning the structure and membership of the other committees. |

| ● | Assists our Board of Directors with oversight and review of corporate citizenship and sustainability matters which may have a significant impact on us. |

| ● | Reviews the composition of our Board in light of directors’ skills, experience, diversity (including, among other things, race, age, gender, sexual orientation and areas of expertise), independence and availability of service, and recommends nominees for each annual election of directors and to fill any vacancies on our Board. |

The composition of the Nominating, Governance and Corporate Citizenship Committee meets the requirements for independence under the current listing standards of the NYSE and current SEC rules and regulations.

The Nominating, Governance and Corporate Citizenship Committee operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of the NYSE. This charter is available under the “Governance” tab of our website at investors.levistrauss.com.

Our Board of Directors met eight times during the last fiscal year. Each director attended 75% or more of the aggregate number of meetings of the Board and of the committees on which he or she served, held during the portion of the last fiscal year for which he or she was a director or committee member.

In accordance with our corporate governance guidelines and applicable NYSE listing standards, executive sessions of non-management directors are scheduled for every meeting of our Board of Directors and at such other times as our non-management directors see fit. All executive sessions of non-management directors are presided over by the Chair of our Board of Directors. In the absence of the Chair of our Board of Directors, the participating non-management directors will select a director to preside over an executive session.

KEY RESPONSIBILITIES OF THE BOARD

| OVERSIGHT OF STRATEGY | OVERSIGHT OF RISK | SUCCESSION PLANNING |

The Board provides unique insights into the strategic issues facing the company. The Board and its committees provide guidance and oversight to management with respect to our business strategy throughout the year. As part of its oversight of business strategy, the Board: ● Reviews our annual and long-term strategic and financial plans; ● Receives regular reports from the various business leads regarding our performance, risks facing the business and our competitive position; ● Reviews and assesses our results and competitive position; and ● Discusses external factors affecting the company. | As described below, the Board of Directors has ultimate responsibility for risk oversight under our risk management framework. The Board oversees policies and procedures for assessing and managing risk, while management is responsible for assessing and managing our exposures to risk on a day-to- day basis. The Board executes its duty both directly and through its committees, as outlined more fully below. | Our leadership team is an important element in our future success. ● Our Chair leads the Board in CEO succession planning. As disclosed in November 2022, the Board appointed Michelle Gass as President and anticipates that she will be elevated to the role of Chief Executive Officer on or before July 2024. ● Through its Compensation and Human Capital Committee, the Board also oversees succession planning for other leadership roles, including executive officers and key members of senior management. |

| 24 | LEVI STRAUSS & CO. |

CORPORATE GOVERNANCE

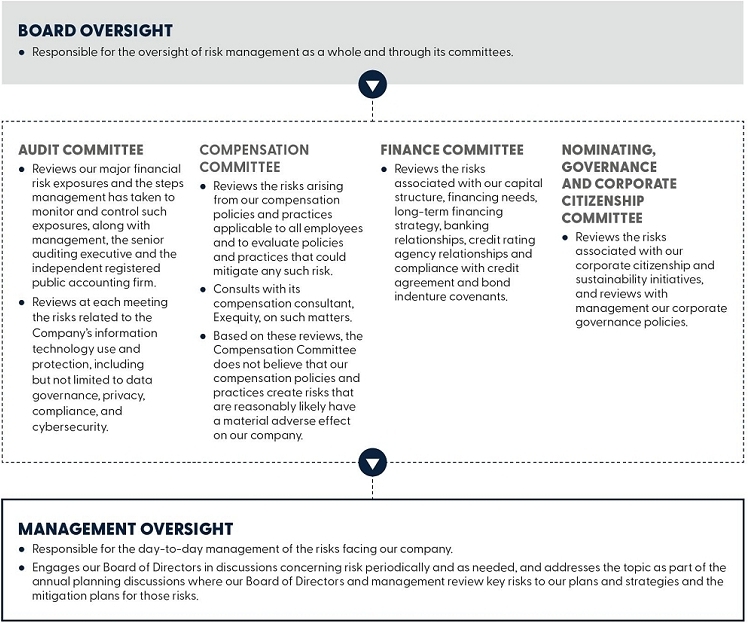

BOARD’S ROLE IN RISK MANAGEMENT

Management is responsible for the day-to-day management of the risks facing our company, while our Board of Directors—as a whole and through its committees—has responsibility for the oversight of risk management.

BOARD OVERSIGHT ● Responsible for the oversight of risk management as a whole and through its committees. | |||||||||

| |||||||||

| AUDIT COMMITTEE | COMPENSATION AND HUMAN CAPITAL COMMITTEE | FINANCE COMMITTEE | NOMINATING, GOVERNANCE AND CORPORATE CITIZENSHIP COMMITTEE | ||||||

● Reviews our major financial risk exposures and the steps management has taken to monitor and control such exposures, along with management, the senior auditing executive and the independent registered public accounting firm. ● At each meeting, reviews the risks related to the company’s information technology use and protection, including but not limited to data governance, privacy, compliance, and cybersecurity. | ● Reviews the risks arising from our compensation policies and practices applicable to all employees and to evaluate policies and practices that could mitigate any such risk. ● Consults with its compensation consultant, Semler Brossy, on such matters. ● Reviews the development, implementation and effectiveness of policies and strategies relating to human capital, including those regarding culture, recruiting, retention, career development and progression, talent planning and diversity and inclusion. | ● Reviews the risks associated with our capital structure, financing needs, long-term financing strategy, banking relationships, credit rating agency relationships and compliance with credit agreement and bond indenture covenants. | ● Reviews the risks associated with our corporate citizenship and sustainability initiatives, and reviews with management our corporate governance policies. | ||||||

| |||||||||

MANAGEMENT OVERSIGHT ● Responsible for the day-to-day management of the risks facing our ● Engages our Board of Directors in discussions concerning risk periodically and, as

| |||||||||

CORPORATE GOVERNANCE

WORLDWIDE CODE OF BUSINESS CONDUCT

We have adopted a Worldwide Code of Business Conduct, applicable to all of our directors and employees (including our CEO, chief financial officer, controller and other senior financial employees). The Worldwide Code of Business Conduct covers a number of topics, including: accounting practices and financial communications; conflicts of interest; confidentiality; corporate opportunities; insider trading; and compliance with laws. The Worldwide Code of Business Conduct is available under the “Governance” tab of our website at investors.levistrauss.com. If we grant a waiver of the Worldwide Code of Business Conduct to one of our officers, we will disclose this waiver on our website.

CORPORATE GOVERNANCE

During our 170 years of business, we have built a platform to drive meaningful social change and environmental action. Over the years we have taken stands on issues such as gun violence prevention, equitable access to the polls, the rights of LGBTQ+ people, and many other issues that are important to our business, our customers and the communities we serve. The Levi Strauss Foundation and the company underpin these efforts with grantmaking support to organizations working for lasting changes on these and other important issues.

We review with the Nominating, Governance and Corporate Citizenship Committee the issues on which we are contemplating taking a stand and with the full Board of Directors where appropriate. In determining which issues to support, we seek issues that directly affect our business and our people and discuss the business, and sometimes moral, case for taking action. We also take into consideration and discuss with the Nominating, Governance and Corporate Citizenship Committee and, as appropriate, the Board, among other things, the potential impact on our business, customers, employees and communities in which we do business, risks related to taking a stand, measures to address and mitigate such risks, and how best to communicate our stance on such issues.

We intend to continue advocating for social change and encouraging others to do the same wherever we see opportunities to contribute to a more just, safe and inclusive society.

WORLDWIDE CODE OF BUSINESS CONDUCT

We have adopted a Worldwide Code of Business Conduct, applicable to all of our directors and employees (including our CEO, President, Chief Financial Officer, Controller and other senior financial employees). The Worldwide Code of Business Conduct covers a number of topics, including: accounting practices and financial communications; conflicts of interest; confidentiality; corporate opportunities; insider trading; and compliance with laws. The Worldwide Code of Business Conduct is available under the “Governance” tab of our website at investors.levistrauss.com. If we grant a waiver of the Worldwide Code of Business Conduct to one of our officers, we will disclose this waiver on our website.

The Board and the Nominating, Governance and Corporate Citizenship Committee oversee the company’s shareholder engagement practices. We engage with shareholders on issues related to corporate governance, executive compensation and composition, sustainability, company performance, and other areas of focus for shareholders. Our engagement with shareholders helps us better understand our shareholders’ priorities and perspectives. We take insights from this feedback into consideration and share them with our Board as we review and evolve our practices and disclosures. In early 2023, our Chair and members of management met with holders of approximately 20% of our outstanding Class A common stock.

SHAREHOLDER COMMUNICATIONS WITH OUR BOARD

Over the years, our Board of Directors and management have had a rich dialogue with shareholders about important issues, and we have in place an effective process that has ensured that various shareholder inputs are heard by our Board of Directors and management.

Our Board of Directors has adopted a formal process by which shareholders may communicate with our Board of Directors or any of its members. Shareholders who wish to communicate with our Board of Directors may do so by sending written communications addressed to Levi Strauss & Co., Attn: Corporate Secretary, 1155 Battery Street, San Francisco, CA 94111. All communications will be compiled by the Corporate Secretary and submitted to our Board of Directors or the individual directors on a periodic basis.

Any interested person may communicate directly with our non-management or independent directors as a group. Persons interested in communicating directly with our non-management or independent directors regarding their concerns or issues may do so by addressing correspondence to a particular director, or to the independent or non-management directors generally, in care of Levi Strauss & Co. at 1155 Battery Street, San Francisco, CA 94111. If no particular director is named, letters will be forwarded, depending upon the subject matter, to the relevant committee chair.

RELATED PARTY TRANSACTION POLICY

We have a written policy concerning the review and approval of related party transactions. Potential related party transactions are identified through an internal review process that includes a review of director and officer questionnaires and a review of any payments made in connection with transactions in which related persons may have had a direct or indirect material interest. Any business transactions or commercial relationships between us and any of our directors or shareholders, or any of their immediate family members, are reviewed by the Nominating, Governance and Corporate Citizenship Committee and must be approved by at least a majority of the disinterested members of our Board of Directors. Business transactions or commercial relationships between us and our named executive officers who are not directors, or any of their immediate family members, requires approval of our CEO with reporting to the Audit Committee.

RELATED PARTY TRANSACTIONS

The following is a summary of transactions since November 24, 2019 to which we have been a participant in which the amount involved exceeded or will exceed $120,000, and in which any of our then directors, executive officers or holders of more than 5% of Class A and Class B common stock on a combined basis at the time of such transaction, or any members of their immediate family, had or will have a direct or indirect material interest.

2021 PROXY STATEMENT21

CORPORATE GOVERNANCE

CORPORATE GOVERNANCE

RELATED PARTY TRANSACTION POLICY

We have a written policy concerning the review and approval of related party transactions. Potential related party transactions are identified through an internal review process that includes a review of director and officer questionnaires and a review of any payments made in connection with transactions in which related persons may have had a direct or indirect material interest. Any business transactions or commercial relationships between us and any of our directors or shareholders, or any of their immediate family members, are reviewed by the Nominating, Governance and Corporate Citizenship Committee and must be approved by at least a majority of the disinterested members of our Board of Directors. Business transactions or commercial relationships between us and our named executive officers (“NEOs”) who are not directors, or any of their immediate family members, requires approval from our CEO with reporting to the Audit Committee. Our NEOs are disclosed under “Compensation Discussion and Analysis.”

RELATED PARTY TRANSACTIONS

During fiscal year 2022, there have been no transactions to which we have been a participant in which the amount involved exceeded or will exceed $120,000, and in which any of our then directors, executive officers or holders of more than 5% of Class A and Class B common stock on a combined basis at the time of such transaction, or any members of their immediate family, had or will have a direct or indirect material interest, other than as noted below.

REGISTRATION RIGHTS AGREEMENT

In connection with our initial public offering in 2019, we entered into a registration rights agreement with certain holders of our capital stock, including Mr. Friedman, Mr. Prime, Mimi L. Haas, Mr. Peter E. Haas, Jr., Margaret E. Haas, Robert D. Haas, the Peter E. Haas Jr. Family Fund, Bradley J. Haas, Daniel S. Haas and Jennifer C. Haas. Pursuant to the registration rights agreement, holders of more than 90% of our Class B common stock have certain contractual rights with respect to the registration under the Securities Act of 1933, as amended (the “Securities Act”) of the shares of Class A common stock issuable upon conversion of their Class B common stock (“registrable securities”).

| ||||||||

| ● | Registration on Form S-3. If we are eligible to file a registration statement on Form S-3, the holders of any then-outstanding registrable securities will have the right to demand that we file registration statements on Form S-3. This right to have registrable securities registered on Form S-3 will be subject to specified conditions and | |||||||

| ● | Expenses of Registration. Subject to